A high offer isn’t always the right one.

If you’re selling in Windsor Cay, it’s not just about price—it’s about timing, terms, and how solid the buyer really is.

This guide breaks down how to evaluate a house offer with confidence, spot red flags early, and choose the one that gets you to closing with fewer surprises.

1. Start with Your Goals as a Seller

Before you even look at numbers, get clear on what you need most from this sale.

- Is your priority top-dollar, even if it takes longer?

- Do you need a fast close to free up funds for your next home?

- Are you juggling Airbnb bookings and need a rent-back agreement or a delayed closing?

Your personal timeline, financial goals, and lifestyle factors should guide your evaluation of each offer, not just the dollar amount on paper.

Here’s how seller goals shape real offer decisions:

- Need time to move or buy another home? Look for offers with flexible or extended closings.

- Prioritizing peace of mind? Cash buyers or those with few contingencies offer smoother deals.

- Selling a furnished vacation rental? Favor buyers who want turnkey rentals over those who plan to gut and renovate.

Talk with your Realtor to define your ideal scenario before comparing offers. That clarity can save you from saying yes to a deal that doesn’t actually serve you.

2. Evaluate the Financial Strength Behind the Offer

Not all buyers are created equal. Before getting excited about the offer price, take a closer look at the buyer’s financial strength, because the last thing you want is a deal that falls apart in escrow.

Pre-Approval vs. Pre-Qualification

One of the fastest ways to filter serious buyers is to look at their mortgage documentation. Here’s a quick breakdown:

| Document Type | What It Means | Why It Matters to You |

| Pre-Qualification | Buyer has discussed finances with a lender but hasn’t verified income or assets | Low barrier, less reliable. Doesn’t confirm they can actually close. |

| Pre-Approval | Lender has reviewed income, credit, and assets; buyer is conditionally approved | Stronger. Shows the buyer has been vetted—fewer surprises later. |

Only consider offers with full pre-approvals or, better yet, proof of funds if it’s a cash buyer.

Cash Offers: Quick and Clean But Not Always King

Yes, cash offers are appealing. They can close faster, eliminate financing risks, and reduce paperwork. But here’s the catch: some cash buyers know they have leverage and come in below asking.

In Windsor Cay, where vacation homes often generate strong rental income, a financed buyer who’s willing to pay more (and truly qualified) could be the better long-term bet if the financing is solid.

Down Payment & Lender Choice

- Larger down payments often signal stronger financial stability and commitment.

- Smaller down payments don’t always mean trouble, but they could indicate a buyer with tighter margins or a higher risk of financing hiccups.

Local or reputable lenders are a big plus. Online lenders or unknown names may delay closing with slow appraisals or underwriting issues.

In short: A strong financial package = less risk, faster close, and fewer surprises. Be sure your Realtor evaluates all supporting documents, not just the offer price.

3. Analyze Contingencies That Could Delay or Kill the Deal

Contingencies are conditions written into an offer that give the buyer a legal way out of the contract. While some are standard, too many can introduce delays or worse, lead to a collapsed deal. The more contingencies in an offer, the higher the risk for you as the seller.

Here are the most common contingencies to look for:

- Financing: The buyer needs loan approval to proceed. If their lender backs out or delays underwriting, your sale could be stuck in limbo.

- Appraisal: If the home appraises below the offer price, the buyer may renegotiate or walk away.

- Inspection: Buyers can request repairs, credits, or back out entirely if issues arise.

- Sale of current home: This means the buyer must sell their home before buying yours, a major red flag unless their sale is already pending.

That said, contingencies aren’t inherently bad. They’re often there to protect both parties. The key is negotiating terms that reduce your risk while keeping serious buyers engaged. You might offer to cap repair credits, request a faster inspection timeline, or ask for a higher earnest money deposit in exchange for keeping certain contingencies.

Clean offers are great, but reasonable buyers should still feel protected, especially in today’s shifting market. A good Realtor will help you strike that balance.

4. Consider the Closing Timeline

Timing can make or break your sale. If the buyer wants to close in 21 days but you haven’t found your next home yet, that “fast” offer might actually create more stress than value.

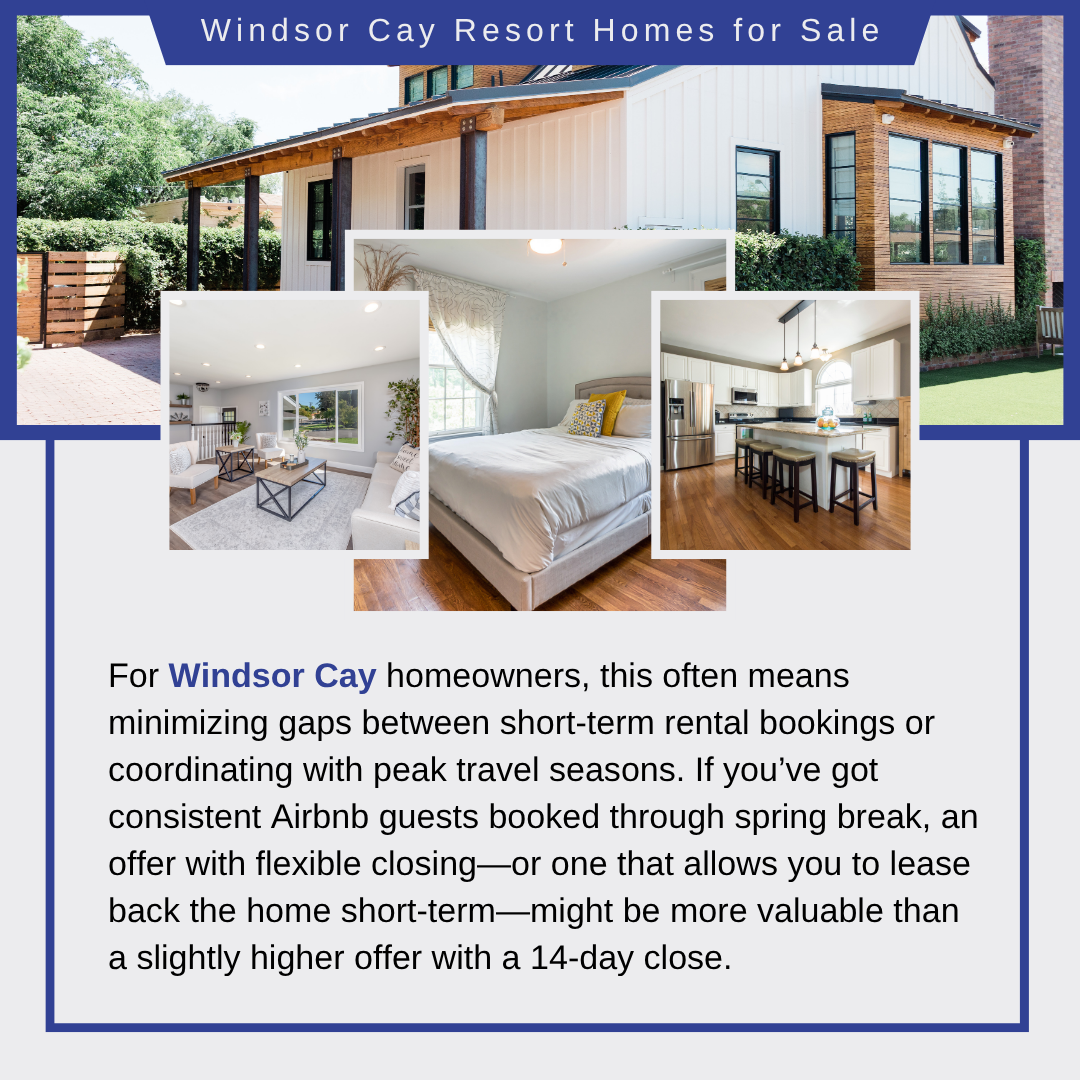

On the flip side, if your Windsor Cay property is booked solid with Airbnb guests for the next month, you’ll need an offer that respects those reservations or one that lets you delay closing until your calendar clears.

Look for buyers who are flexible with the timeline or open to rent-backs. These small details can give you room to move out smoothly without rushing, canceling bookings, or paying double for housing. Always match the closing date to your situation, not just theirs.

5. Should You Read the Buyer’s Letter? (And Why It’s Tricky)

It might feel heartwarming to read a letter from a hopeful buyer, but be cautious.

These letters often include personal details (like family background or future plans) that could unintentionally lead to fair housing violations if used to influence your decision.

While it’s natural to connect with emotion, the safest and smartest path is to evaluate every offer strictly on its terms: price, contingencies, financial strength, and timeline.

In Windsor Cay, where many buyers are investors or vacation home seekers, letters rarely add value and often introduce unnecessary legal risk. Focus on the numbers and the terms. Leave everything else off the table.

6. Watch for These Red Flags in Any Offer

Not all offers are as solid as they seem. Before you get too excited by a high number, scan for these deal-killers that could cost you time—or worse, derail the sale entirely:

- Tiny earnest money deposit: Signals low commitment or financial instability

- Excessive repair requests: Could be a tactic to lower the final price later

- Financing from obscure lenders: Slower approvals, higher fallout risk

- Vague offer documents or unrealistic terms: Lack of clarity = red flags

- Contingency overload: Every added condition increases the chance of delays or cancellations

If you’re unsure about any part of an offer, your Windsor Cay Realtor should flag it early, before you lock in the wrong deal.

7. Compare Net Proceeds—Not Just the Offer Price

The highest offer isn’t always the most profitable. What truly matters is what you walk away with after everything is said and done. Here’s what to factor in:

- A lower offer might actually net more if it comes with fewer concessions or covers more of your costs

- Use a seller’s net sheet (your agent can help) to calculate your real bottom line

- Watch for credits, closing cost requests, and commission structures; they all impact your final profit

Even though Offer A looks better at first glance, Offer B could actually net you more money and close with fewer strings attached. Always compare the bottom line, not just the top number.

8. When to Accept, Counter, or Wait

Multiple offers on your Windsor Cay home? Great—but don’t rush. The first offer might feel exciting, but that doesn’t mean it’s the best one you’ll get. Here’s how to play it smart:

- Accept when the offer meets your goals, has clean terms, and comes from a well-qualified buyer.

- Counter if the offer is close but needs tweaks—like a better price, fewer contingencies, or a timeline that fits your plans.

Wait, if you’ve just hit the market, showings are strong. Let interest build. Creating urgency can drive better offers.

Your agent can guide you through the right call, but remember: you’re in control. The key is knowing when to negotiate and when to move forward.

Work With a Trusted Local Realtor (It Matters More Than You Think)

The right agent isn’t just a middleman, and they’re your first line of defense against bad offers, costly mistakes, and buyer tactics that could derail your Windsor Cay sale.

An experienced, numbers-forward Realtor knows what to look for:

- Offers that seem great but hide red flags

- Buyer terms that won’t hold up under inspection or appraisal

- When to push back, and when to walk away

Local market insight means a smarter strategy. And when you’re selling in a high-demand vacation rental community like Windsor Cay, that edge can mean thousands more at closing and far fewer regrets.

📣 Ready to Sell in Windsor Cay?

Let’s talk strategy. I’ll help you price smart, evaluate offers with clarity, and negotiate from a position of strength.